Several companies are racing to introduce autonomous vehicles. There is a lot of complexity associated with the AV Investment Opportunities landscape. Both hardware and software players are represented, including both start-ups and publicly traded corporations. It provides an overview of the rapidly evolving autonomous vehicle space.

Silicon Valley’s newest unicorn is secretive AV startup Zoox, which raised $250 million in funding as an Investment Opportunity. The recent investment frenzy in AVs points to an increasing investment frenzy.

Investment Opportunity in Vehicles

The vehicle itself is the first layer of the AV ecosystem. Large capital investment and manufacturing expertise are required to produce vehicles at scale. Even large, deep-pocketed technology companies — like Google and Uber — have shown little interest in manufacturing their own vehicles.

The most likely outcome is that traditional automakers will continue to mass-produce cars. In the future, this manufacturing role may not be as profitable for these companies. Car manufacturers may become increasingly commoditized, low-margin businesses as value creation shifts to high-tech components and software.

Read Also: Car Parking Sensors: 5 Things To Know Before You Buy One

By now, most traditional car manufacturers are investing in autonomous vehicles. Mercedes-Benz, Volvo, and GM have interesting autonomous programs.

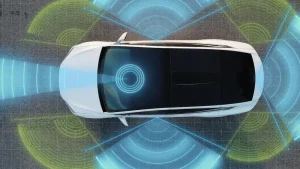

Lidar sensors

Lidar is one of several specialized sensors that assist AVs in interpreting their environment. A Lidar sensor allows the vehicle to detect its surroundings in three dimensions by projecting lasers in all directions and measuring their return time.

Since Lidar sensors are crucial to overall AV functionality, there will be a huge Investment Opportunity for them. Startups that specialize in their production have recently emerged.

The company that is able to harness Moore’s Law to drive both of these dimensions down the fastest will have a huge advantage. It cost Google $80,000 to purchase the Lidar sensors it used for its AV prototypes.

Currently, Velodyne leads the Lidar manufacturing market with a $500 sensor. It is still early days for Velodyne, a privately held firm in California.

Read Also: LiDAR Sensors In Autonomous Vehicles: What Is Their Use And Importance?

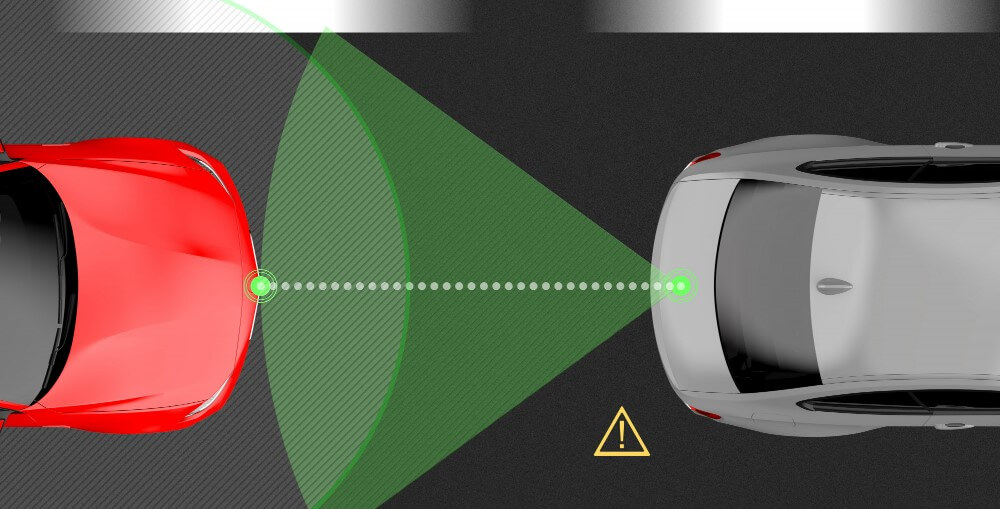

Camera: Investment Opportunity

Cameras assist AVs in understanding their environment. When identifying traffic lights and signs, cameras can detect color, a significant advantage over Lidar.

One of the leading AV camera makers, Mobileye, has high-profile supplier contracts with Tesla.

Software

AVs are intelligent, or autonomous, because of their software, not hardware. AV software comes in several types. It’s important to note that the distinction between hardware and software companies isn’t entirely clear.

For example, Mobileye provides software for analyzing sensor data. Some of the companies below that are classified as software players also provide hardware.

Mapping and localization

Mapping and localization software is critical to AVs.

To navigate effectively, an AV must know where it is on the map. It is extremely challenging to build and update such a map database. HERE and TomTom are two of the biggest players in global map databases. It’s no surprise that each of these companies has received significant investment attention.

A handful of smaller startups are also working on mapping capabilities, alongside Google and Uber.

Cybersecurity

In an increasingly connected world, cybersecurity will become increasingly important. Earlier this year, white-hat hackers remotely cut the transmission of a Jeep Cherokee in an important warning about connected vehicles.

Fleet operations and management

It is predicted that AV fleets will replace private car ownership as the autonomous era dawns, with individuals summoning them only when needed. It will be an enormous challenge to manage this fleet and optimize its routes.

Some startups are already taking on this challenge, such as Riddell, which raised $11.7 million from BMW and Khosla Ventures in April. Uber may invest and compete vigorously here given its strategic positioning and commitment to autonomous technology.

AV artificial intelligence learning

In AV, the central technological breakthrough is the vehicle’s ability to make advanced and adaptive decisions based on all the available data. This is the most important and technically challenging AV technology category. There are a few companies developing such solutions.

Some of these companies focus only on software; to go to market, they will partner with or be acquired by hardware manufacturers. For instance, NuTonomy recently announced plans to deploy driverless taxis in Singapore by 2018.

Conclusion

Companies in the AV industry are fluid and fast-changing in these early days. Autonomous vehicles are a fiercely competitive field with established automakers, large technology companies, and cutting-edge start-ups. Autonomous vehicles will offer huge profits and Great Investment Opportunity in the years to come.